As we step into 2025, it’s more important than ever to stay ahead of evolving tax brackets, investment thresholds, and estate planning limits. Whether you’re managing a household budget, running a business, or planning for retirement, understanding the latest numbers can make a significant difference in your financial outcomes.

Below, we break down the most relevant updates in individual tax rates, capital gains, estate and gift tax exemptions, and other critical thresholds that may impact your planning for the year ahead.

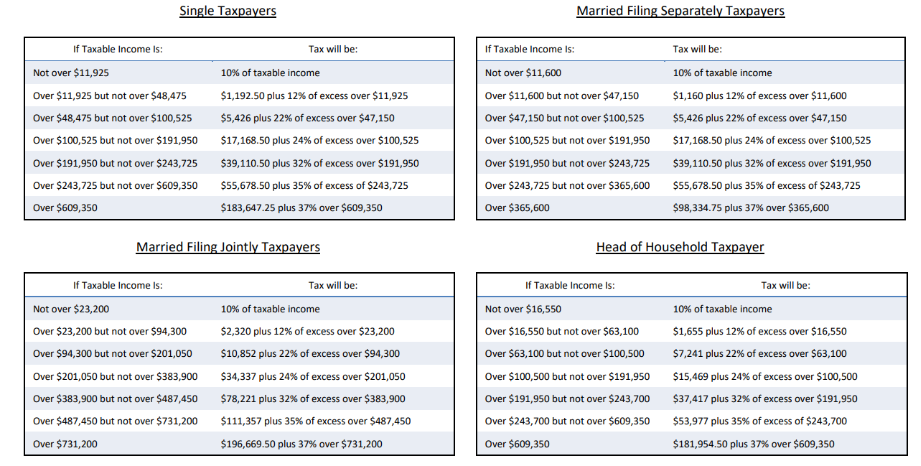

Tax brackets remain adjusted for inflation. The progressive structure means that income is taxed in layers, not as a flat rate. Reviewing where your income falls within these brackets can help you assess withholding, estimated payments, and strategic deductions.

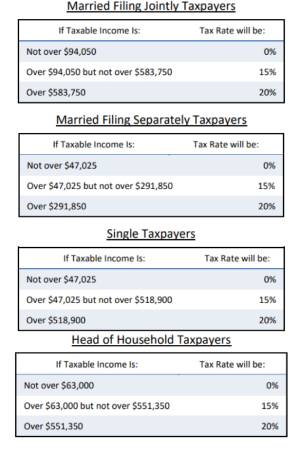

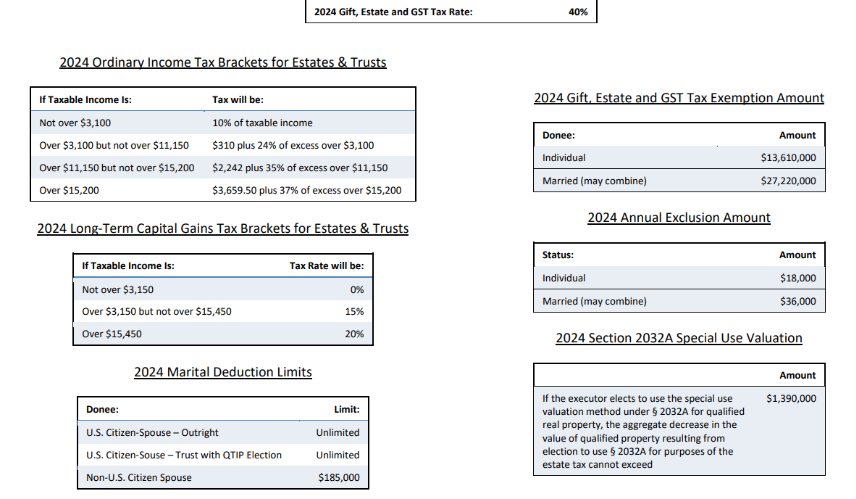

Depending on your filing status and income, the long-term capital gains tax rate remains at: 0,15%, or 20%.

Capital gains rates still favor long-term investments. If your taxable income is under a set threshold, you may pay 0% on gains. This creates planning opportunities for harvesting gains, gifting appreciated assets, or structuring sales over multiple years.

These income thresholds for Net Investment Income Tax and Additional Medicare Tax are not indexed for inflation, meaning more taxpayers may be affected over time.

NIIT (3.8%) and the Additional Medicare Tax (0.9%) apply once income crosses fixed thresholds—$200K for single, $250K for joint filers. As wages and investment returns grow, more individuals are drawn into this surtax zone. Consider income shifting and tax-exempt investments.

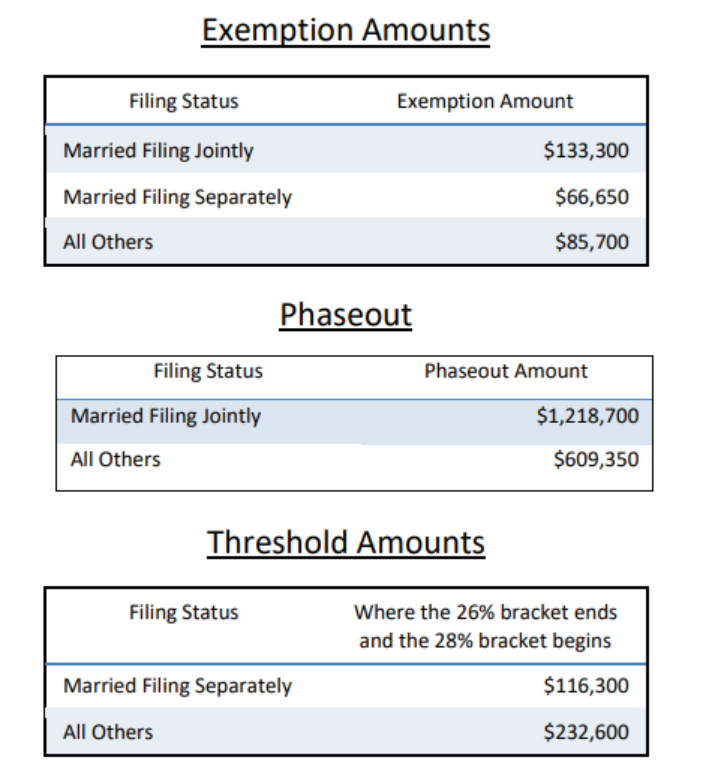

The AMT recalculates taxable income by disallowing certain deductions and preferences. Fewer taxpayers are affected post-TCJA, but it still impacts high-income households with incentive stock options or large state tax deductions. Strategic timing of income or deductions may mitigate exposure.

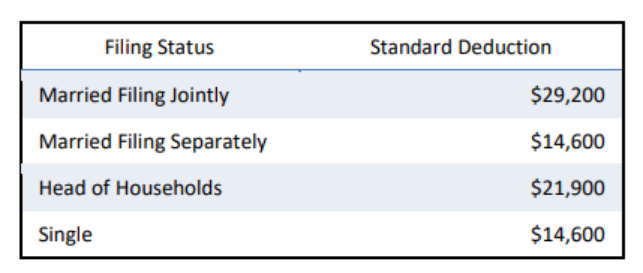

These inflation-adjusted amounts reduce taxable income and simplify filing for non-itemizers. Taxpayers nearing the itemization threshold may benefit from “bunching” deductions into alternating years or leveraging charitable giving strategies.

Note: These are still based on 2024 levels but apply to current estate planning decisions unless Congress enacts changes.

For 2024, the unified estate and gift tax exemption remains at $13.61 million per individual.

With frequent legislative updates, planning opportunities can shift quickly. Our team is here to help you:

Whether you’re seeking a mid-year review or preparing for tax season, our professionals are available to walk you through your options with clarity and confidence.

Contact us today to schedule a consultation and make the most of 2025’s tax planning.

Partner with our bilingual CPA team for expert guidance in tax, assurance, accounting, and advisory services tailored to your business needs.

San Francisco-Based CPA Firm Since 1986

Providing assurance, accounting, tax, and consulting services to local, national, and international clients with personalized attention and bilingual support.